🚀 DefiLlama Swap: Redefining the DeFi Aggregator Landscape

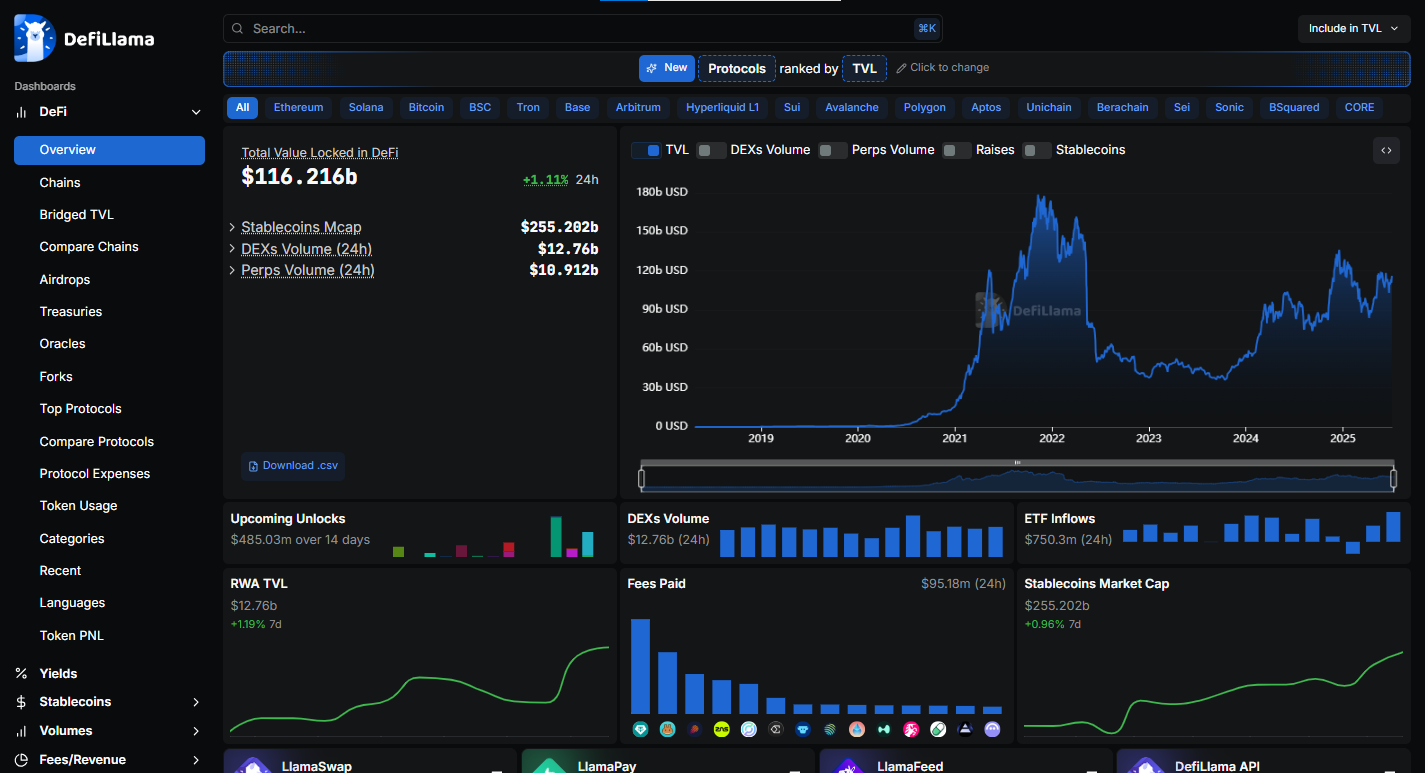

In the ever-evolving world of decentralized finance (DeFi), innovation stands as the lifeblood of growth. Among the latest breakthroughs capturing the attention of crypto enthusiasts is DefiLlama Swap—a sophisticated, user-centric DEX aggregator introduced by the team behind the renowned DefiLlama analytics platform. This groundbreaking tool promises to revolutionize how users navigate decentralized exchanges by offering unparalleled transparency, optimal routing, and zero additional fees.

🔍 What is DefiLlama Swap?

DefiLlama Swap is a meta-DEX aggregator, meaning it doesn’t just compare liquidity pools across individual decentralized exchanges (DEXs); it aggregates across multiple DEX aggregators such as 1inch, Matcha, Paraswap, and Cowswap. This multi-layered approach allows it to scan a far broader liquidity landscape, ensuring users receive the best possible trade execution at any given moment.

Moreover, unlike many platforms that layer additional costs or extract value via hidden markups, DefiLlama Swap is completely free—charging no extra fees or receiving any portion of the transaction as a kickback. Its entire ethos rests on the principle of maximizing user gains, not platform profits.

🧬 How Does DefiLlama Swap Work?

At its core, DefiLlama Swap employs advanced routing algorithms that delve into multiple aggregators simultaneously. Here’s a simplified flow of how it functions:

- User initiates a swap request (e.g., swapping ETH for USDC).

- DefiLlama Swap queries major DEX aggregators in real-time.

- It compares quotes from each, factoring in slippage, gas costs, and available liquidity.

- The platform displays the most cost-efficient route to the user, who then executes the swap directly.

This design not only optimizes for the best possible execution price but also provides complete transparency by showing all the alternative paths considered—empowering users with data to make informed decisions.

🌟 Why is DefiLlama Swap Unique?

Several standout features distinguish DefiLlama Swap from other DEX aggregators:

- Aggregator of aggregators: Instead of routing only through individual DEXs, it leverages multiple aggregators, dramatically increasing the probability of finding the most competitive rates.

- Zero platform fees: DefiLlama doesn’t impose an additional layer of fees, making it more cost-effective compared to other services that extract platform revenue through spreads or referral fees.

- Open-source & transparent: True to DefiLlama’s ethos, the swap interface and smart contracts are publicly auditable, bolstering trust within the community.

- Multi-chain support: DefiLlama Swap seamlessly operates across numerous EVM-compatible blockchains like Ethereum, Arbitrum, Optimism, and Polygon, among others.

🛠️ Use Cases & Benefits

The advantages of using DefiLlama Swap are manifold:

✅ Maximized returns: By integrating multiple DEX aggregators, it consistently seeks out the most efficient trading paths, thereby improving execution prices. ✅ Lower transaction costs: Zero platform fees mean traders keep more of their capital. ✅ De-risked trading: Users can compare all routing options in a single interface, reducing the chances of hidden costs or suboptimal execution. ✅ Suitable for both retail & institutions: Whether you’re a retail trader swapping $100 or a fund moving six figures, DefiLlama Swap scales effectively.

📈 The Broader Impact on DeFi

DefiLlama Swap’s emergence signals a maturation in the DeFi ecosystem—one where data transparency, competitive pricing, and fee minimization take precedence over rent-seeking behaviors. It also pressures other aggregators to innovate, cut hidden fees, or risk losing savvy users.

As more capital flows into decentralized exchanges, tools like DefiLlama Swap will likely play a pivotal role in shaping how liquidity is discovered and accessed. For institutional desks or high-frequency bots, accessing an “aggregator of aggregators” translates to direct alpha generation.

🔮 Final Thoughts

In a decentralized world often plagued by opaque practices and extractive intermediaries, DefiLlama Swap shines as a beacon of fairness and innovation. It distills the complexity of navigating fragmented liquidity into a streamlined, data-driven experience—empowering traders of all sizes to execute with confidence.

Whether you’re a DeFi novice looking to minimize costs or an experienced trader chasing optimal routes across chains, DefiLlama Swap is unequivocally worth exploring. As the DeFi space continues to expand, expect it to remain at the forefront of routing innovation, setting new benchmarks for what DEX aggregators can achieve.

Made in Typedream